Personalisation in retail is nothing new. Retailers and brands have been treating their customers as individuals well before the advent of online shopping, and for good reason. Personalisation works. Personalisation helps stores anticipate their customers’ needs, save them time, and provide offers that resonate with them. In fact, research from Fresh Relevance shows that almost half of shoppers (41%) would drop a retailer who sends irrelevant offers and one in four actively want to be sent offers and recommendations based on previous purchases.

But what exactly is eCommerce personalisation?

Ecommerce personalisation is when eCommerce stores deliver personalised and relevant experiences throughout their website and across email, through dynamic content and product recommendations based on shopper data, such as location and past purchases.

Fresh Relevance partners with UniFida to deepen the level of personalisation based on the UniFida Customer Data Platform. UniFida provides identity resolution to build a single view of a customer and deeper insight and targeting such as customer value, dormancy, or responsive to price reductions.

This provides real-time behaviour and insight combined with the power to act on it and enable cross-channel personalisation.

Read on to learn about three key benefits of personalisation in eCommerce.

1. Personalisation increases conversions

In today’s crowded digital landscape, competition is fierce and keeping shoppers’ attention is becoming increasingly vital. Personalisation helps eCommerce stores create seamless, tailored experiences that reduce bounce rate and friction and ultimately boost conversions.

The average Fresh Relevance client doing web personalisation sees an 8% increase in sales. What’s more, research from Epsilon shows that 80% of consumers are more likely to make a purchase when brands offer personalised experiences. In fact, 74% of consumers actively feel frustrated when website content isn’t personalised.

Here are some conversion-boosting personalisation tactics for eCommerce.

Geotargeting

A shopper’s physical location has a big influence on their interests and needs when engaging with an eCommerce store. So, it makes sense to treat customers differently based on where they are located and use geotargeting tactics to ensure that they see offers most relevant to their current context.

Try adding details of the shopper’s nearest store for click and collect options on the cart page. Or display weather-based dynamic banners on your website and in emails to showcase appropriate products.

Product recommendations based on personification

Every shopper has different tastes and preferences. So eCommerce stores should take note and treat each visitor to their site accordingly to ensure they resonate with everyone.

To convert visitors into customers, try displaying ‘people like you buy’ product recommendations. This type of recommendation looks at the shopper’s past browse or purchase history and compares it with other shoppers who have viewed those products, using a machine learning algorithm to recommend the most likely eventual purchases. It appeals to the shopper’s desire to follow the wisdom of the crowd, putting their purchase decision into the capable hands of their shopping predecessors.

Shoppers can also have different preferences when it comes to price. A tool like Fresh Relevance’s Price Affinity Predictor uses AI to predict the price level that will appeal to each new website visitor, helping you recommend the most relevantly priced products and keep visitors on your website.

Triggered emails

Triggered emails are an effective way to deliver personalised, real-time content to shoppers at the moment they are most likely to convert.

Two types of triggered emails to add to your email marketing toolkit are cart and browse abandonment emails. These messages are triggered when a shopper abandons a browsing session or their shopping basket without making a purchase. The average Fresh Relevance client doing both cart and browse abandonment emails sees a sales uplift of 16%.

Other types of triggered emails proven to boost conversions include price drop and back in stock alerts.

2. Personalisation improves customer loyalty

Consumers have come to expect a personalised experience from retailers and brands, and are more likely to return to stores that fulfil this expectation. According to Salesforce, 70% of consumers say a company’s understanding of their personal needs influences their loyalty.

With a wealth of browse and past purchase data available at the average eCommerce store’s fingertips, it has never been more possible to foster customer loyalty through personalisation.

Here are some eCommerce personalisation tactics that improve customer loyalty.

Product recommendations based on behavioural data

Ecommerce stores can start their loyalty campaigns straight after a customer has made a purchase, with post-purchase emails containing product recommendations that complement the item they’ve just bought.

Making recommendations based on the customer’s frequently browsed and purchased product categories is another effective way to foster loyalty and resonate with existing customers. Including these types of recommendations in your email newsletters helps bring customers back to your website, and displaying them on the homepage encourages customers to keep browsing and make a purchase.

Welcome back popover

Ecommerce stores can help customers pick up where they left off when they return to the website by including a popover to remind visitors of their last viewed product. Customers will appreciate the gesture, as they do not have to waste time finding the product they searched for last time.

Replenishment emails

For customers who have purchased perishable products that will need replacing, such as medicine or cosmetics, triggered replenishment emails serve as a useful reminder that the time to reorder is approaching. This type of triggered email helps boost customer loyalty and increases the likelihood of repeat purchases.

3. Personalisation encourages customer advocacy

Personalised experiences lead to happy customers, and happy customers often feel compelled to recommend brands and retailers they love to their network. A study by Forrester found that 77% of consumers have chosen, recommended, or paid more for a brand that provides a personalised service or experience.

Beyond customers becoming advocates without any prompting thanks to a fantastic, personalised experience, eCommerce stores can use personalised post-purchase campaigns to encourage customer advocacy.

Try adding user-generated content (UGC) to your post-purchase emails to give customers inspiration on how to use or wear their new product, and let them know how to share their own UGC by telling them which social media channel to use and the relevant hashtag.

Post-purchase emails are also an effective way to gather reviews and ratings. Frequent buyers are an ideal source for positive reviews and ratings, so be sure to encourage them to share their experience by sending review requests.

Final thoughts

The eCommerce space is becoming increasingly competitive, and shoppers can switch to another brand at the click of a button. To convert and retain today’s consumers, providing personalised experiences isn’t a nice-to-have, it is essential.

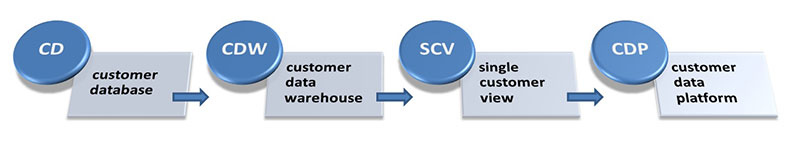

A real-time personalisation and optimisation platform like Fresh Relevance helps digital marketers and eCommerce professionals drive revenue and customer loyalty. Combined with UniFida this enables identity resolution, single customer view and enhanced insights to enable cross-channel personalisation.

Download Fresh Relevance’s free eBook to learn more about building personalised experiences for your customers with Fresh Relevance.

This guest post was written by Fresh Relevance, a personalisation and optimisation platform for digital marketers.

UniFida is the trading name of Marketing Planning Services Ltd, a London based technology and data science company set up in 2014. Our overall aim is to help organisations build more customer value at less marketing cost.

Our technology focus has been to develop UniFida. Data science business comes both from existing users of UniFida, and from clients looking to us to solve their more complex data related marketing questions.

Marketing is changing at an explosive speed. Our ambition is to help our clients stay empowered and ahead in this challenging environment.