Below are some frequently asked questions about customer journey-based marketing attribution – and some insightful answers.

What is customer journey-based marketing attribution?

People usually receive or respond to multiple communications on their way to making a purchase. These can be online, such as a Facebook ad, or offline, such as receiving a catalogue. Customer journey-based marketing attribution looks at all the interactions between a customer and an organisation before a sale in order to analyse the role of each interaction, and hence their contribution to the sale.

Which channels are normally included?

We expect to include all ‘direct’ channels, in other words those where there is a one-to-one relationship between the customer and the company, or where there is a direct link through an online user clicking on a digital ad (such as PPC) and visiting the company’s website. An email is direct because it goes to a known recipient, whereas a press ad is not because the recipient is unknown. However indirect channels, such as TV, press, and outdoor, can also be very important. These require a different attribution technique called econometrics.

How do you link the steps in a customer journey?

We start by putting a snippet of code on your website to enable us to download into our attribution platform all of your (first party) website visitors’ browsing activity, including, most importantly, how they arrived at your site. This allows us to distinguish, for instance, between a referral, a branded search or a natural search. We then link the browsing to any offline journey steps by joining them to individuals using identifiers they have provided. To obtain the non-web contact activity we ingest feeds into our Customer Data Platform (CDP) from sources such as your email service provider, direct mail contact history, and your order processing system.

As not all journeys lead to a sale, what do you do with the unsuccessful journeys?

The brutal truth is that for attributing value to marketing activities we ignore them, which is not to say that the unsuccessful journeys are unimportant as they are key when we aredescribing customer journeys overall and understanding the total spend through a particular channel (i.e. we need successful plus unsuccessful spend). But a campaign will only have value attributed to it from the journey steps it created that led to a successful outcome.

How far back in time do you go when looking at customer journeys?

We normally look back 90 days before each sale, although some clients ask us to look at shorter periods, e.g. 30 days. To a large extent it depends on the type of purchase and the channels used. For instance, a catalogue will have a much longer shelf life than an opened email, so we need to give it time to have its effect.

How do you decide on what weight to give to each step in a customer journey?

It is obvious that all journey steps are not of equal importance, so weighting them correctly is crucial to obtaining a successful attribution outcome. There is a great deal of online discussion about this subject, with different approaches being debated, but we have opted for a method which is mainly based on the time intervals before and after each journey step.

If, for example, an event happens just before a sale, we give it a high closing score. In contrast, if there is a long interval after the first event, then we conclude that it could not have had too much of an impact on initiating the sale. We also give credit to events that help keep the customer interested without actually closing the sale. If you would like a more detailed note on how our weightings work, we would be pleased to share this with you.

Are there certain types of event that you ignore?

Yes. Multiple opens of the same email on the same day is one example, as is a visit to PayPal just before closing a sale. We try to eliminate anything that does not contribute to the customer’s decision to purchase.

Can you distinguish the different behaviours of different customer groups when responding

to marketing events?

We can. For example, new and existing customers behave entirely differently in terms of the kinds of journeys they make and what marketing events they respond to. Another way we divide up customers is between those who mainly search and buy online and to those who order through a call centre. But you may also wish to look at the impacts of marketing on different types of customer segment, and our platform can support that.

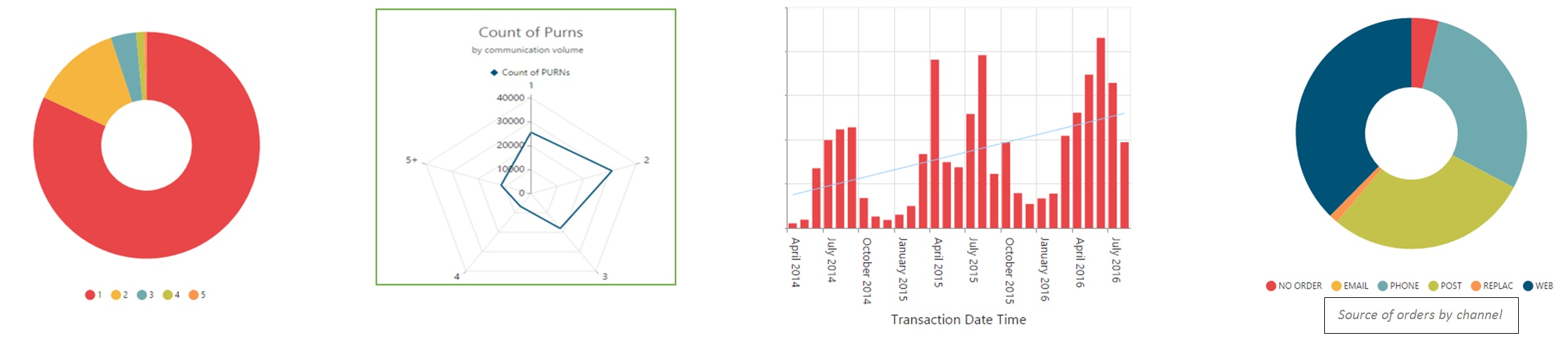

Do you look at how different channels perform at different times of year?

We do, and we find very significant seasonal differences. To show this, we have a specific report providing month-by-month summaries so that we can, for instance, compare email or any other channel’s performance in one month with another.

Do you always look at sales when calculating marketing attribution, or can you look at other goals, such as lead generation?

We often look at non-sale outcomes, and, for instance, recently we have been working for a charity that they wanted us to look at how they get their users to take up different tools that they provide on their website. When looking at non-sales outcomes we lose the value element that we have in a sale, but otherwise the process works in an identical way.

How up-to-date are your reports?

They are always available online at any time and the data behind them is processed each night. So on any day you will be looking at results up to midnight the day before.

Do you aim to answer questions other than the value obtained from customer journeys?

We are finding that this is an increasingly important area, and to respond to our clients’ requests we are building a whole suite of customer journey reports. These will answer questions about the lengths of journeys, the mix of channels used and the sequence in which they appear in the journeys.

Is customer journey-based attribution GDPR compliant?

Yes. It uses only your organisation’s first party data and excludes cookie and analysis opt-outs, for example.

Why not just use Google?

Whether you are using Google Ads or the new or old version of Google Analytics, they have well-documented flaws – namely inaccuracy and incompleteness. Google Ads uses the last Google Ads click, but Google Analytics uses the last click across all channels, so over-reports as it does not take into account other channel’s contributions. Google recognises that this is an issue and has developed Google Analytics 4 (GA4) to

replace the previous version called Universal Analytics – but this will not solve the core flaws. GA4 will use black-box algorithms and again will not take into account all marketing activity. Google is sampled and segments cannot be applied retrospectively for analysis.

Google does not use first-party data or individual identifiers, so it cannot be joined to other data sources of marketing activity.

UniFida is the trading name of Marketing Planning Services Ltd, a London based technology and data science company set up in 2014. Our overall aim is to help organisations build more customer value at less marketing cost.

Our technology focus has been to develop UniFida. Data science business comes both from existing users of UniFida, and from clients looking to us to solve their more complex data related marketing questions.

Marketing is changing at an explosive speed. Our ambition is to help our clients stay empowered and ahead in this challenging environment.