Forrester has based this claim, that analytics is a top marketing priority, on a survey of 750 analytics decision-makers in larger companies employing more than 500 people (‘The Future of Analytics’, Forrester, July 2020).

To quote from the report: Analytics is a top marketing priority. Of the ten marketing priorities we surveyed, marketers ranked improving their use of data and analytics as a top priority over the next twelve months. More than six in 10 marketers (63%) indicated that analytics was in their top five priorities. In separate research, Forrester found that improved analytics drives business results. In that, connecting customer data across formerly siloed product lines and connecting customer and behavioural data across channels can inform digital improvements that increase sales.

Forrester then went on to ask about what was inhibiting companies from delivering analytics with the following results:

With this in mind we want to explain what we are doing to help marketers using our UniFida technology get the analytics they need.

First, we have removed the problem of siloed data. UniFida’s cloud-based customer data platform technology ingests data from people browsing wherever we can match it to customers, as well as from ecommerce, customer order systems, email service providers, call centres, and where available retail. It then uses all available personal identifiers to build the single customer view. We end up with a ‘single silo’ of all customer data being made available for analysis.

Next, we have integrated with Microsoft Power BI so that data manipulation and visualisation can be undertaken. Power BI allows you to create virtually any report you want and publish it within your organisation. Inside UniFida, Power BI can use all the online and offline data available in the single customer view to tell you how your customers are performing and what they are responding to.

Then to help automate reporting we have built into UniFida a suite of standardised marketing metrics. At the click of a few buttons this will tell you all you need to know about customer acquisition, customer retention, and customer value. It can also tell you how your marketing campaigns are performing, and help you compare test results. All this updated every time UniFida receives new data.

Finally, we have just released our innovative solution to marketing mix modelling. We call it ADEE or algorithmic direct event evaluation. By looking at all the online and offline events that occur in the 90 days before a sale, and using our proprietary AI to weight them, we can tell you what are the drivers behind every order. When summed up this tells you precisely the contribution made by each direct marketing channel you are using from Google PPC to catalogues or email.

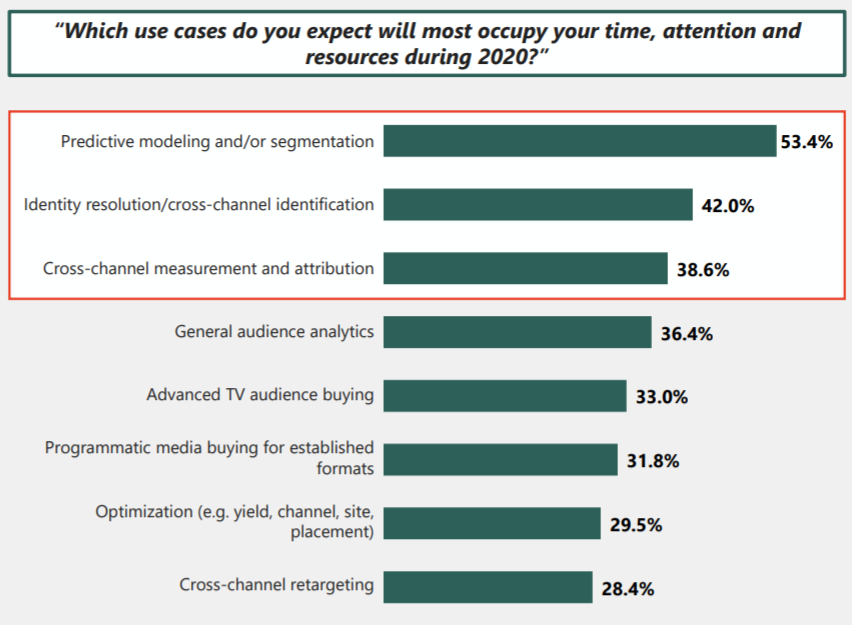

We are not trying to say the UniFida has an automated answer to every analytics question you can throw at us, but we expect that it will definitely cover the majority of them. And for those that it cannot solve we have our in-house data science team who can for instance build you a customer segmentation, or a propensity model to predict which of your dormant customers are most likely to be reactivated.

Forrester says that analytics is a top marketing priority. Many of the team who developed the UniFida technology have come from a marketing data science background, so every decision we have made when designing the tool has incorporated the need for marketing analytics.

So, let us know if you would like a quick demo of what UniFida can deliver, as we would be delighted to show you it in action.

UniFida is the trading name of Marketing Planning Services Ltd, a London based technology and data science company set up in 2014. Our overall aim is to help organisations build more customer value at less marketing cost.

Our technology focus has been to develop UniFida. Our data science business comes both from existing users of UniFida, and from clients looking to us to solve their more complex data related marketing questions.

Marketing is changing at an explosive speed, and our ambition is to help our clients stay empowered and ahead in this challenging environment.